Why AI Isn't a Bubble (How It Differs from the Dot-Com Bubble) & Investment Thesis

Arguments that the AI industry is overvalued and forming a bubble are becoming increasingly common. However I believe we are witnessing a mega-trend: a Super Cycle that will last for at least the next 5 to 10 years.

Here are three interconnected reasons why AI is structurally different from the Dot-Com Bubble.

1. High Barriers to Entry (The Moat)

Unlike the Dot-Com era, the barriers to entry in the AI sector are astronomically high.

During the internet boom, almost anyone could add “.com” to their company name, IPO, and drive up stock prices based purely on narrative. Today, you cannot simply “decide” to be a major AI player. Competing in this space requires more than just technical ambition. It requires massive Free Cash Flow (FCF) and proprietary data.

Only a select few companies possess the capital to build and operate hyperscale data centers and the vast datasets required to train frontier models. Effectively, this limits the playing field to the Hyperscalers (Google, Meta, Microsoft, etc). These companies already possess the world’s highest profitability, fortress balance sheets, and deep economic and technical moats.

The Dot-Com bubble was fueled by debt-ridden startups with no revenue. The AI rally is led by the most financially sound, cash-rich companies in history.

2. Valuations Supported by Earnings

The most recent earnings reports (Q3 2025) confirm that valuations are being driven by tangible results, not hype.

Demand for enterprise AI adoption is explosive, with companies reporting significant gains in productivity and efficiency. This is reflected in the financials of the industry leaders:

-

Nvidia (AI Hardware): Revenue grew 62% YoY (22% QoQ), and EPS surged 60% YoY (24% QoQ).

-

Palantir (AI Software): Revenue increased 63% YoY with an EPS of $0.21.

To measure software efficiency, we often look at the Rule of 40, where a successful SaaS company is defined by: Revenue Growth (%) + EBITDA Margin (%) ≥ 40.

Palantir recently recorded a score of 114%.

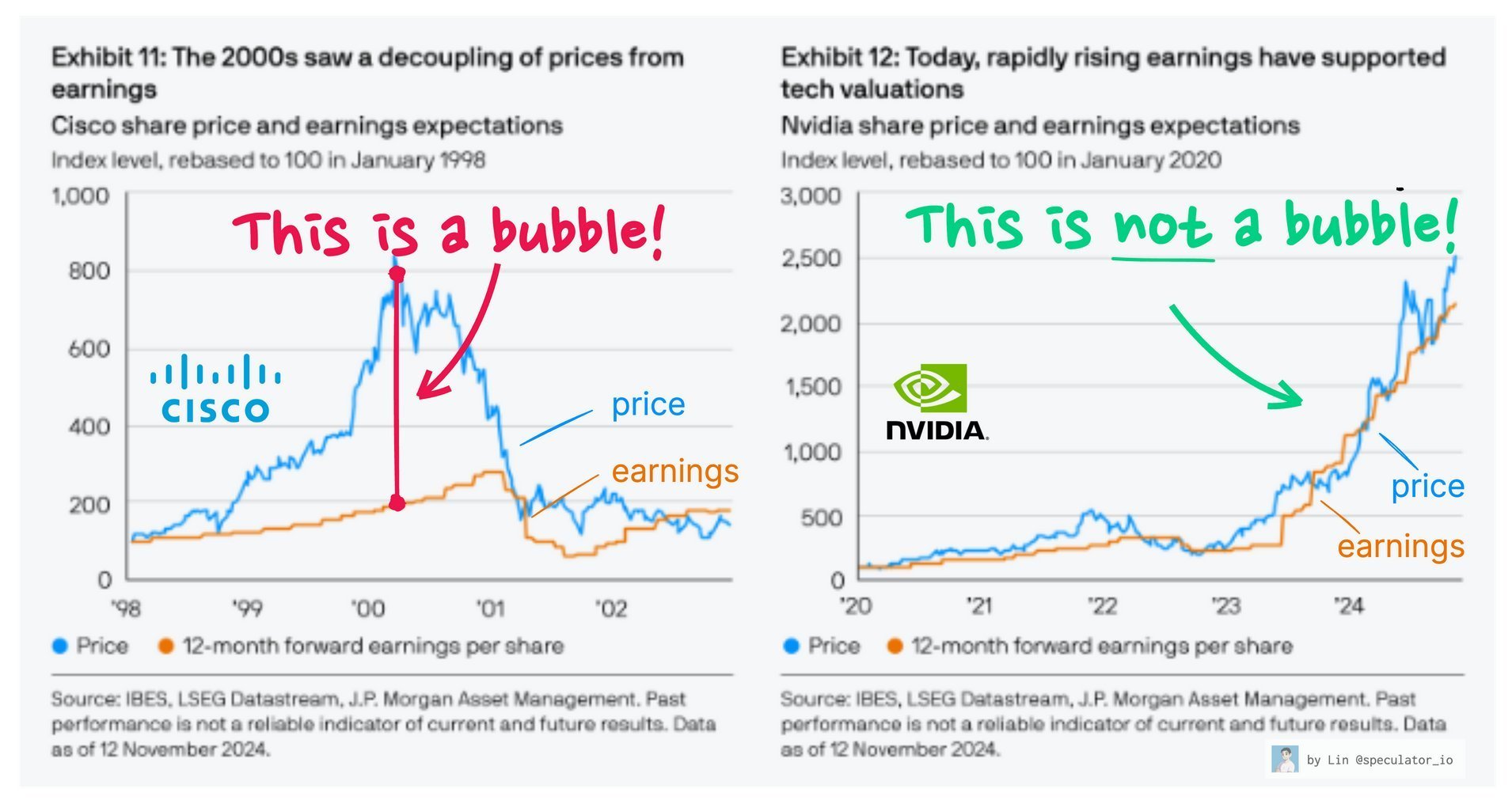

Comparing the price/EPS charts of Cisco (the poster child of the Dot-Com bubble) during its peak against Nvidia today supports the argument that the current trend is fundamentally different. Nvidia’s price appreciation is tracking its earnings growth; Cisco’s was pure multiple expansion.

3. Investor’s Learning Effect

The market has learned from history. Investors distinctly remember how the Dot-Com bubble burst, leading to a healthy level of skepticism today.

Paradoxically, the recurring debates about an “AI Bubble” are healthy for the market. A bubble typically bursts when euphoria takes over completely (when investors stop questioning the gap between “dreams” and “reality” (earnings). Currently, the market is constantly weighing this gap.

In finance, we say “stocks climb a wall of worry.” As long as investors remain cautious and scrutinize the disparity between hype and results, the trend remains sustainable. The moment fear and critical thinking vanish, that is when the true bubble begins.

My Investment Thesis

Based on this Super Cycle, here are the sectors and specific assets I find attractive.

1. Hyperscalers

-

AMZN (Amazon): The prime beneficiary of AI-driven efficiency. AI directly boosts revenue and decreases operational costs, leading to hyper-growth in net income.

-

GOOGL (Google): Just as Apple locked consumers into their ecosystem, Google is positioned to lock global users into its comprehensive AI service ecosystem. They do everything, plus AI.

-

META (Meta): While Apple has dominated personal mobile devices, Meta is betting on the next form of personal device: AI Smart Glasses. If their vision for personal superintelligence is correct, they are currently leading the race for the next hardware platform.

2. AI Software & Services

- PLTR (Palantir), ZETA

3. AI Infrastructure

- AMD, IREN, NBIS: We are still in the early stages of LLM (Large Language Model) development. We have yet to fully tackle “World Models,” and the demand for compute is twofold: Training (teaching the models) and Inference (running the models). Data center demand is nowhere near its peak.

4. The Contrarian Play: Duolingo (DUOL)

I believe the gap between the market’s perceived potential/risk and my own perception of potential/risk is the return.

-

The Market View: It seems like many believe AI will replace language learning apps or slow down human learning, viewing AI as a “risk” to Duolingo.

-

My View: AI is not a threat, but it is a catalyst. Duolingo already holds a dominant market share. AI perfects their content generation and personalization, making the platform sticky without replacing the human desire to learn. Furthermore, Duolingo’s vision extends beyond language to Math and Music, aiming to become the global “All-in-One” learning platform. AI is the tool that makes this scale possible.

Conclusion

Optimists will make money, and pessimists who sounds smart may gain reputation. But those with no opinion make nothing.